Being the executor of an estate can be a time-consuming job, depending on the size and complexity of the estate. While a simple estate can take a few months and not require a huge time commitment, if there are problems, the job can drag on for years.

The amount you can gift to any one person without filing a gift tax form is increasing from $15,000 to $16,000 in 2022, the first increase since 2018. Many people remember the $10,000 per person limit, which has increased over the years to $16,000. Remember – tax law and Medicaid law are like oil and water – there are NO free gifts for Medicaid.

Attorney Louis W. Pierro has spent nearly four decades focusing on legal issues relating to estate planning, trusts, and business plans. This in-depth expertise in corporate law prompted TIME Magazine to reach out for his opinion on the accuracy of the HBO hit Succession. Along with two other corporate attorneys– and fervent fans– Mr. Pierro offered insight and legal advice to the characters of this addictive satirical drama.

Pierro Featured in TIME Magazine

Waystar Royco, a fictional version of the world’s largest media and entertainment conglomerate and a highly dysfunctional dynasty, is at the heart of the show. Succession chronicles a high-profile family’s power struggle to dominate the company when the patriarch’s health begins to decline.

The media mogul’s children go to great lengths to gain an advantage– or personal favor– with their father, Logan Roy. His oldest son contends that his father personally oversaw and condoned the cover-up of decades worth of sexual intimidation and exploitation on their cruise line.

Accuracy of Legal Drama Succession

In the TIME Magazine article, Louis Pierro weighs in on a number of pressing issues with staff writer Andrew Chow.

AC: How common are father and son power struggles in the corporate world?

Pierro: I do see that all the time—and the impact that has on the kids who are waiting around saying, O.K., when is it my turn? But I haven’t seen too many cases where one of the children tried to jump up and pull that business out before the dad was ready to let go.

AC: How do general counsels deal with conflicting loyalties to different members of a family in addition to the company itself?

Pierro: I represent a company that is owned by five siblings. One of them is in the controlling position, but the other four siblings have raised a number of issues. My duty of loyalty, in that case, is to the company, as I am corporate counsel. So, when push came to shove, I had to recommend to the CEO that he get personal counsel to represent him individually in what ended up being a shareholder battle.

AC: How common is it for corporations to refuse to cooperate with federal authorities?

Pierro: It’s a strategy of many corporations to obfuscate, deny and hide. With the feds, it depends on who’s doing the investigation and how much of a pitbull they are. But in the corporate world, evidence is disappeared all the time. That is a common practice, unfortunately.

Expert Business, Estate and Tax Planning Legal Services

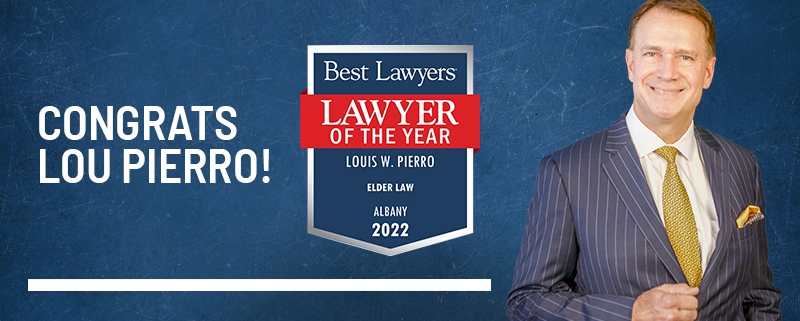

Louis Pierro has been recognized for “Trusts and Estates” by Best Lawyers and has maintained an AV preeminent rating from the Martindale-Hubbell since 2001. The legal team of Pierro, Connor & Strauss, LLC offers expert advocacy in business planning, estate and trust litigation, and tax planning for individuals and families from all walks of life. We are proud to offer personalized legal services to clients in ten locations that include the Capital Region, New York City, Long Island, Westchester, Hudson, Utica, Lake Placid, Fort Lee, NJ, Falmouth, MA, and Clearwater, FL. Contact us today for a free consultation

State Steps Back from Pioneering Progressive Social Policy. New “Lookback” Provision to Cause Penalties, Delays.

The care available to New York’s most vulnerable seniors and people with disabilities is facing draconian changes, with new rules announced by the Department of Health that will limit eligibility and access for new Medicaid applicants.

Read moreThe opportunity to make proper use of the present $11,700,000 Federal Gift Tax exemption, and the opportunity to fund and sell to Grantor Trusts, form and fund Grantor Retained Annuity Trusts, fund Qualified Personal Residence Trusts and other planning techniques, may be gone in a matter of days.

Read moreBy: Pierro, Connor & Strauss Attorneys

Summary: Congratulations to our Founding Partner, Louis W. Pierro, for being named 2022 Lawyer of the Year for Elder Law in Albany, NY.

Read moreBy: Pierro, Connor & Strauss Attorneys

Summary: Congratulations to our Founding Partner, Louis W. Pierro, for being named a New York Super Lawyer for Elder Law and to Senior Associate Attorney, Frank Hemming III, for being selected as a New York Rising Star for Elder Law in the 2021 Edition of Super Lawyers.

Read moreBy: Pierro, Connor & Strauss Attorneys

Summary: Britney Spears’s legal fight to wrest back control over her personal and financial affairs has flooded the issue of guardianship in Klieg lights. While a full guardianship may be necessary for many individuals who are incapable of managing their own affairs due to dementia or intellectual, developmental or mental health disabilities, the Spears case underlines the option of more limited alternatives.

Read moreBy: Louis W. Pierro and Peter J. Strauss, Esq.

Summary: A new law modifies the format, usefulness and enforceability of the current document by: 1. Eliminating the need for a separate statutory gifts rider, which had led to many problems regarding validity 2. Allowing for minor language or formatting variations from the official statutory form rather than declaring the entire document ineffective 3. Authorizing substantial fines on financial institution that fail to honor a valid power of attorney

Read more